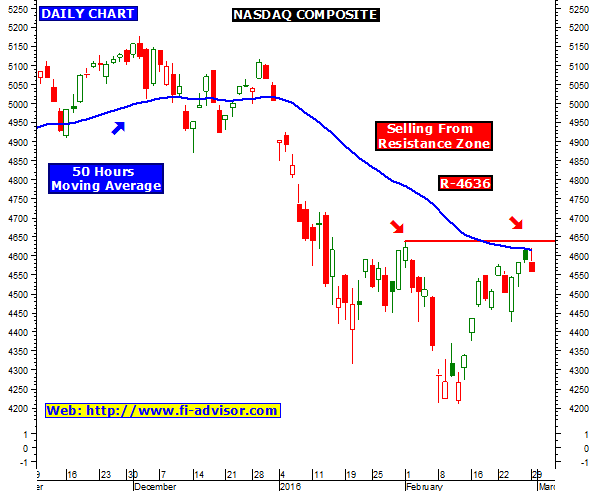

NASDAQ COMPOSITE

Nasdaq composite currently witnessing selling pressure from 50 hours moving average and strong trend line resistance zone @ 4636 technical indicates as long as it holds below bears will be favored and further weakness can be seen in coming days.

Bulls action can be seen once it closes and holds above 4636 in daily chart as shown in above technical image,